Here’s a rambling update in the writing-instead-of-financial-advice-or-psychological-therapy vein.

I recently had a bit of a setback in my sailing adventures when I ran my boat into a big rock and damaged the keel and potentially other parts of the hull. I’m resolving my best path forward.

Insurance

I buy my home and car insurance through USAA. When I purchased my sailboat, I contacted USAA and they did not have coverage available for me. I can’t tell you what led me next to Progressive, but I called them up and they were easy to work with. The value of the boat was set at $30K (my purchase price), and I had a $3,750 deductible. I was paying $550 a year in premium. I have no idea if this was good or bad, but it didn’t seem awful. I haven’t made an insurance claim in 20 years. I’m pretty unfamiliar with the process.

After I had my boat hauled out at KKMI Sausalito, the initial take from the yard was that there was a good deal of damage and that the mast would come out, the keel would drop and then we would know more. KKMI stands for Keefe, Kaplan, Maritime Incorporated and once the extent of my project was evident, Ken Keefe became my main point of contact. He has the practiced bedside manner of someone who has shepherded other boat owners through the travails of an expensive keel strike problem. He took time with me to talk through the process, did not push me in one way or another, and I came away with confidence that regardless of the problem, it was a decent decision to go to KKMI Sausalito.

Ken was somewhat concerned about working with Progressive Insurance. I asked what other companies they dealt with frequently and BoatUS and Geico were offered.

The people at Progressive have been very responsive and after hauling the boat on Monday, a surveyor/adjuster was in the yard on Tuesday. Ken had prepared an estimate for the initial diagnostic work of pulling the mast and dropping the keel. The total is $8k, a majority of which is labor related to getting the keel and hull secured safely in the yard. That’s just to see what’s wrong. To take the boat apart. Not to put it back together. $8k.

The Progressive people went away to do some head-scratching and would come back to me. In the event of a ‘total’ the policy would pay me the lesser of $30k or the ‘Actual Cash Value.’ I thought that given the improvements I had made to the boat since purchase, the boat was probably worth 35k-40k. The Progressive analysts came to this conclusion independently and decided to ‘total’ my boat, and have given me two options.

The first option is to let them total the boat in which case I wind up with ($30k – deductible) and no boat.

They said they had received a salvage bid for the boat for $5k. As in, someone would give them $5k for the boat and take it away from the yard etc..

Thus the second option is to wind up with ($30k – deductible – salvage value) and a boat.

So, do I want to buy a beautiful 32-200 with new rigging, good sails, a nice windvane and electronics but that might have some difficult-to-access hull-grid connection issues, for $5k?

Well, how much is it going to cost to fix?

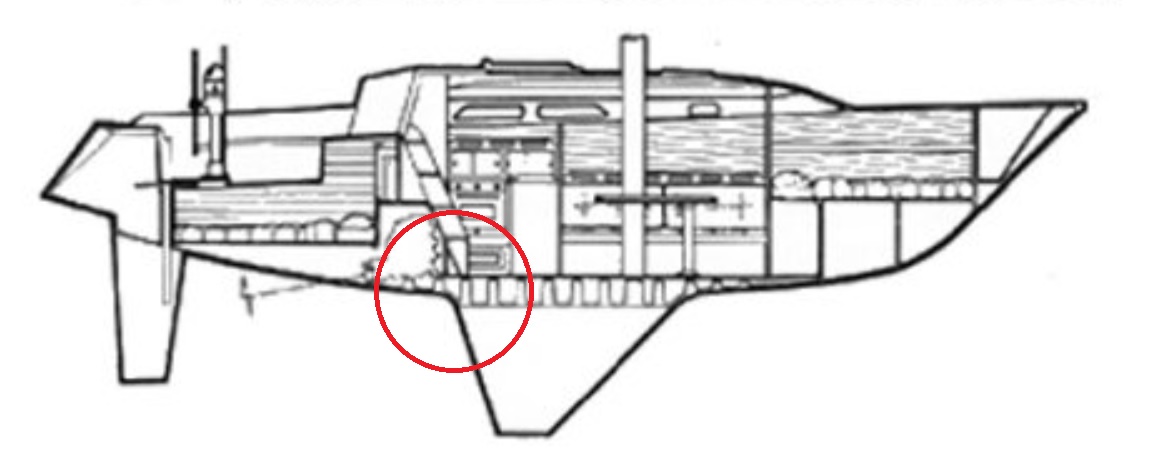

The hypothesized repair involves replacing a 2’ square section of fiberglass in the hull at the point where the back of the keel meets the hull. In a 32-200 the leading edge of the engine is nearly atop this connection point.

This tight location means that in addition to the mast being pulled and the keel being lowered, the engine will probably have to be pulled. Oy!

I have found that if I am dealing with a person who know his or her business and I ask them, “Well, how much will it cost?” and they say, “I won’t know until I get started” then a few things usually follow:

First, I’m better off than if I have a person who will pluck a low number out of the air and trade on hopes and dreams. I fix old houses as investments, and the issue is the same – one can’t tell how much damage or rot is behind a wall until the lathe and plaster come off.

Second, the cost answer is never a particularly low number.

The ballpark that KKMI has given me is $40k +/- $10k.

A final point on the insurance: Evidently there is no concept of a ‘salvage title’ for a boat the same way there is for a car. My Coast Guard registered hull would just transfer ownership unless destroyed. Probably worth thinking about as one is shopping around for a used boat. I would of course disclose the work done to my boat to a future buyer, but it will not be ‘branded’ with a salvage/rebuilt title like a car might.

Option 1:

Repurchase my boat for $5K on my boat and another $40k to fix it, to wind up with a $45k 1990 Ericson 32-200 that I know and like.

Option 2:

Take the money and quit sailing, at least for a while. That’s not what I want to do. I made one brief, very costly mistake, but the project is not done.

Option 3

Take the money and find another boat. What’s out there as a replacement?

Boat 1: Antares, 1987 Ericson 32-3 in Sausalito, $34.5K

I went to see this boat – it is in good cosmetic shape. Nice brightwork, good canvas, pretty clean inside. Has not been sailed much lately. Great day sailer for the bay. Perfectly fine boat. I can’t stretch out lengthwise on the bench settees in a 32-3. The 32-200 benches are longer. The cabin in a 32-3 feels bigger than a 32-200 due to the engine placement, but that’s a tradeoff for more space moving into the rear stateroom and the head in the 200. Antares has a Universal.

Suppose I bought this boat for $30k, I would be back nearly at square 1 with where I was last year when I began work on Sure Shot. Standing rigging, boom rehab, mast rehab, new electronics, all that stuff. Whew.

I could, theoretically, buy Antares, take off my rig, mast boom and all from Sure Shot and keep the best-of from both boats and then sell the to-be-repaired boat to someone with more time and energy. But I would also like to have my Yanmar. Swapping two engines would start to make the Frankensteining complicated and well, they are both older engines etc. etc.

Boat 2: Lorelei, 1996 PSC Ericson 350 (34-2) in Alameda $75k

This is a beautiful boat. The backstory as I understood it from the broker is that a couple bought or owned this boat on the east coast and had it shipped out to California. They replaced the standing rigging, did some other work. Since then it seems to have been little used. It feels just like my 32-200, only a tad bigger. Crealock-style ports that appear not to have ever leaked. The hull form is a 34-2, but the deck mold is different.

The boat was already in contract near the asking price when I went to see it.

It still would have taken some time to upgrade the electronics and add a better pilot etc. No free lunch.

Boat 3: Modern equivalent? Hanse 348 +/- $200K

What’s the old saying? If it float or flies or (flirts) you’re supposed to rent it. Buying a brand new boat would go seemingly go against most financial common sense, (but doesn’t any boat ownership do that too?) It’s mostly idle thinking, but I think a Hanse 348 would be a realistic modern replacement for my current boat. Goes fast, easy to sail, etc. etc. Mmmmmmmmm.

The dimensions of the Hanse are closer to the Ericson, just a bit bigger:

| Boat | Ericson 32-200 | Hanse 348 | |

| Length Over All (Sailboat Data) | 32.5′ | 32.78 | |

| Length at Waterline | 25.83′ | 31.33 | |

| Displacement | 9,800lbs | 13,889 | |

| Ballast | 4,200lbs | 5071lb | |

| Sail Area | 496sf | 630 | |

| “I” measure | 42feet | 44.62sf | |

| Deep Keel Draft | 6.04 feet | 6.4 feet | |

| Beam | 10.83 feet | 11.48 | |

| Price | 30K and up | 155k and up |

I read somewhere the best yacht to buy is one that is 1-2 years old where all the bugs have been worked out. That’s probably true. The idea of a new shiny boat ready to go is pretty enchanting, but money is of course, an object.